Save Money to Travel: Points and Miles

Budgeting for travel and travel hacking your way to a million miles for free flights and hotelsNote from Helen and Tim Travel: Opinions expressed here are of Helen and Tim Travel’s and not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved, or otherwise endorsed by any of the entities included in the post.

Affiliate links: Some of the products and services we recommend contain affiliate links that give us a small commission if you make a purchase and add no additional cost to you. These commissions support Helen and Tim Travel to continue to create content, resources, and travel videos. We appreciate you stopping by and we are thankful for your support!

We currently have accrued over 1,500,000 combined travel points and miles and that number continues to grow every day. During the last 6 years, we discovered strategies to help us earn and save travel points to redeem for free airfare and hotel stays. In this process, we learned to save money so we can travel more. We are going to show you our strategies and tips to earn more points and miles!

Travel Hacking

Our main goal here is not to be experts in speaking about earning travel miles or telling you how to budget for travel, but rather to share strategies and resources that we have used and have come across that have been helpful to us.

During the last 6 years, we discovered strategies to help us earn and save travel points to redeem for free airfare. Also, we generally do not pay for the entire cost of trips up front, which satisfies our appetites as budget conscious travelers that like to plan ahead and spend money in a thoughtful way. We understand that each person has a different method to save for travel and earn miles.

We currently have over one million combined miles and travel points saved and that number grows every day. So why are we saving up so many travel miles?

Throughout our journey of saving travel miles, each year we travel both internationally and domestic around the United Sates, and often times we either redeem our miles for free roundtrip airfare or at least cover one way flight costs for the both of us. The long-term goal with this method of saving for travel will help us budget for future trips and travel more. We hope to save a large bulk of points and miles to be able to travel the world one day when we reach financial independence. (Learn more about our financial independence journey here).

Before we knew what earning travel miles meant, we used to pay with our debit cards for every purchase. Not only was that a security risk (one time our debit card number and pin was stolen and someone spent over $9,000 in less than 30 minutes). Credit cards have greater protections against unauthorized charges. FDIC laws state , “If your card is lost or stolen, your losses may be limited to $50 as long as you notify your issuer promptly.”

We are going to share our strategies on money saving tips and budgeting for travel, as well as the type of credit cards and shopping strategies we use to earn miles.

We are always learning more (travel miles is a life-long process) and we would love to learn how you are earning travel miles. Drop a comment below to share!

Airline Frequent Flyer Programs

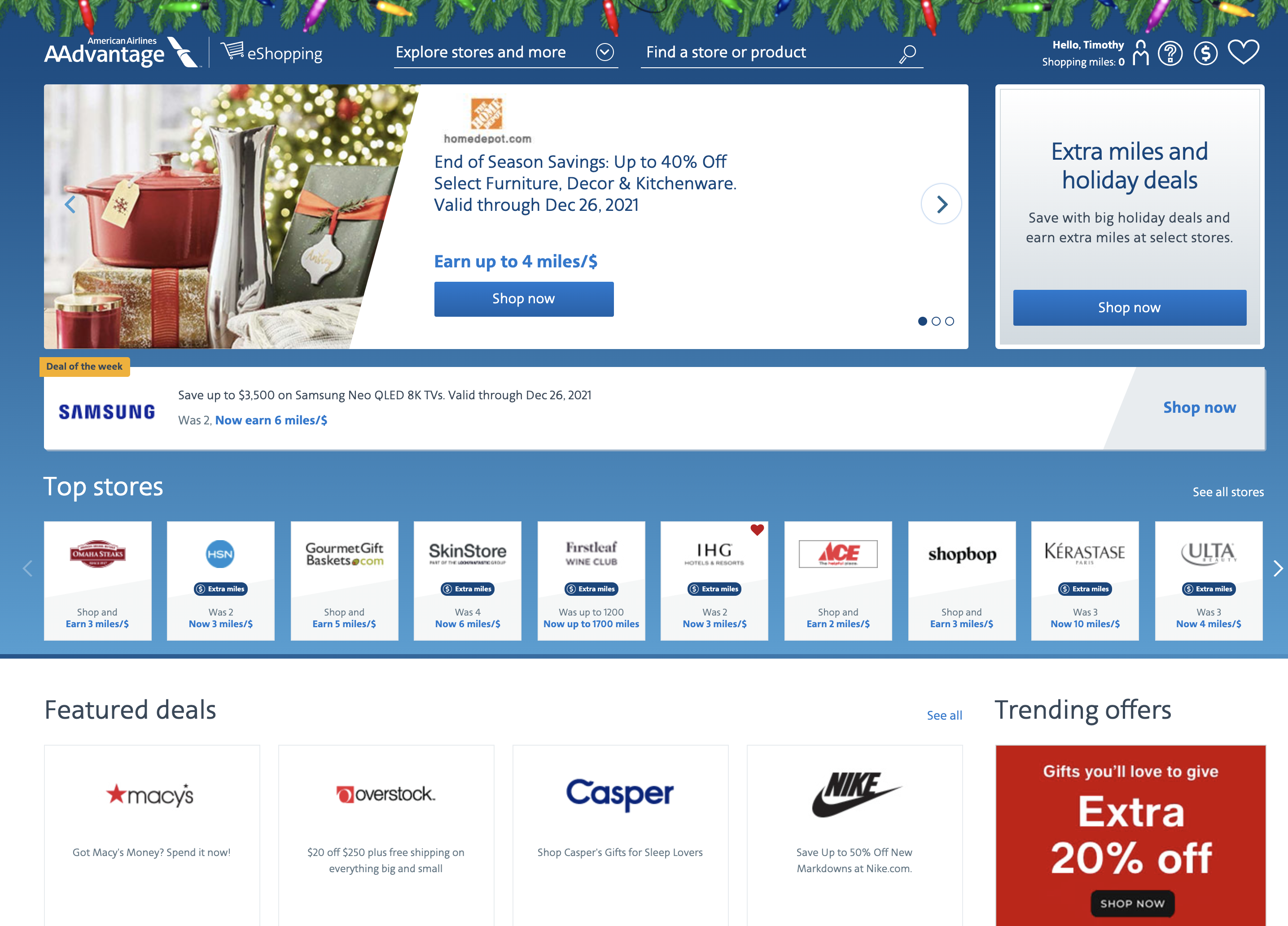

Signing up for airline rewards programs and their partnering credit cards is one of the first strategies we started with. Since we are based out of Portland, Oregon (and before Dallas, Los Angeles, and Nashville) the most common airlines we both fly domestically include Alaska Airlines and American Airlines. Our first step was to sign up for the frequent flyer programs for each of our most commonly travelled airlines. For example, American Airlines has the AAdvantage Program, Alaska’s Mileage Plan, and Southwest Rapid Rewards loyalty programs.

We also love to check to see what type of airline alliances are out there. Alaska and American Airlines both happen to be a part of the OneWorld Alliance, which means you can redeem your airline miles across their partnering airlines on their airline miles redemption portals. The other major member airline alliances are Star Alliance and Sky Team.

Additionally, we have credit cards from each of these airlines. It is a good idea to get the extra perks, especially if you fly with one airline over another. The Alaska Airline cards gives us a companion pass each year meaning we we can essentially buy one roundtrip ticket domestically and get a second ticket for $121 ($99 plus taxes and fees from $22). There are other perks like free checked bags, better seat selection, preferred boarding, and earning extra miles when you spend on their airlines.

Pro Tip: Another way to earn airline points and miles and use them on your favorite airlines is to have a family of credit cards, such as the Chase Freedom, Chase Freedom Unlimited, Chase Sapphire Preferred, and/or Chase Sapphire Reserve cards. You are able to save up Chase Ultimate Rewards points and combine them across the Chase cards and transfer and redeem them on the airlines of your choice. We also do the same with our American Express cards too! Just remember, once you transfer them out to an airline frequent flyer program, they can not be reversed and put back in your credit card points balance.

AIRLINES/HOTELS/CAR RENTAL REWARDS PROGRAMS TRACKING SHEET (GOOGLE SHEETS FILE)

FREE DOWNLOAD! Updated 2023

Do you want to maximize on your travel points and miles? Want to track your airline, hotel, and car rental rewards programs all in one easy, convenient place? We have created a free Google Sheets download to track your frequent flyer programs, airline alliances, hotel elite benefits, car rental credit card perks, and more!

Our Google Sheets tracker is now available! Subscribe to our email list below to receive this resource straight to your inbox. If you are subscribed and did not receive it, contact us and we will get it to you.

JOIN OUR TRAVEL COMMUNITY!

Subscribe to our YouTube channel and watch, like, and comment on our videos!

Subscribe to our newsletter below! We send out 1 to 2 newsletters per month

Follow us on Instagram @helenandtimtravel for behind the scenes on hiking, travel, and more!

Join our Patreon community for workshops, Q&A’s and virtual events on credit card points and travel

Earning Travel Points & Miles: Credit Cards

We have used several different strategies to earn travel points and miles over the years. Our favorite ways include using credit cards, shopping portals and points stacking techniques.

Credit Cards: Signing up for credit cards is the most popular and easiest place to start, at least in our opinion. As mentioned earlier, we shifted our spending from debit cards to credit cards years ago to maximize on earning travel miles. We have always thought if it was already part of our daily expenses (gas, groceries, etc.) why not get something out of it? (We only recommend getting into the credit cards points and miles game if you are able to pay off the entire credit card bill every month!)

Many credit cards that focus on travel have a nice sign-up bonus where you can earn between 40,000 to sometimes 100,000 points with a minimum spend of $3,000 to $6,000 between a 3 to 6 months period when you first sign up for the card.

Credit card points can be redeemed for flights by transferring your points to participating airlines partners, booked directly through the credit cards travel portal, or you can redeem the points earned for cash back, and sometimes gift cards. This is a great breakdown on redeeming Chase Ultimate Rewards Points and gives lots of helpful examples for miles redemption.

It is not common for many people like us that are knee deep in credit card points earning to have between 5 to 20 credit cards. I think we currently have 9 cards and add 1 or 2 each year. Keep in mind these credit cards can have annual fees associated with them between $95 to $695, but are often offset by perks like access to airline lounges, travel credit, discounts on travel, cash back to streaming services, TSA pre check and global entry credit, and more! For example, we have the Amex Platinum. The Points Guy has a great article on how you can earn 100,000 miles with the Amex Platinum card.

We have shared below some of our current credit cards that we use to earn points and miles. Click each of the cards to see the current points offers. If you sign-up, we both receive travel points and miles.

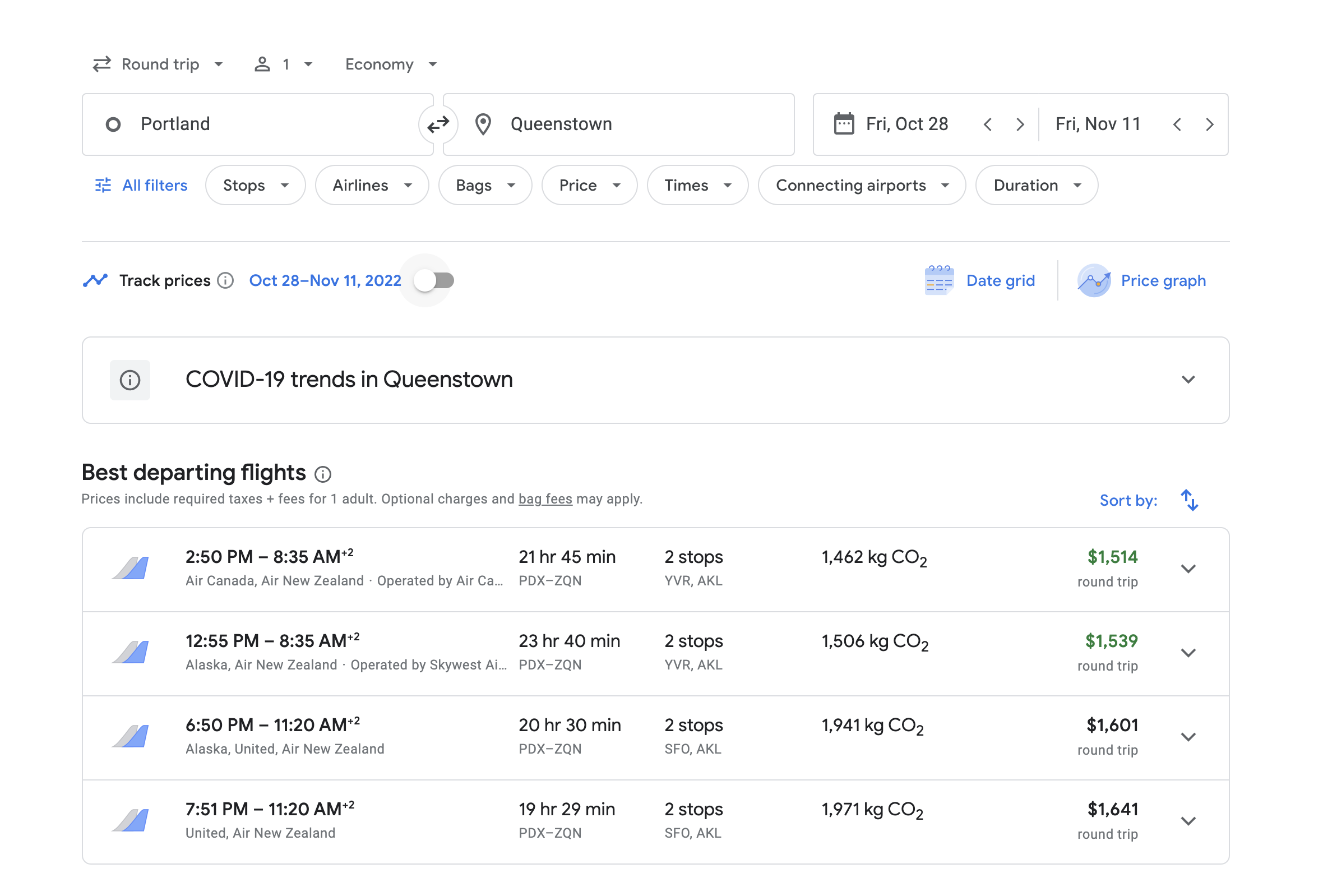

Pro-tip: Make sure to check different airports when you are redeeming your travel points. Point redemptions (especially for business and first class) may be better out of larger airports where there are more frequent flights out to a destination. It may be worth purchasing flights or redeeming your miles to get to an airport that has more flight options. Point redemptions to destinations can be different across airline carriers can be different, so make sure to check Sign up for something like the The Points Guy App to track your points.

Our Favorite Credit Cards for Earning Points & Miles for Travel!

- No annual fee

- 5% cash back (5x points) per $1 spend on rotating bonus categories each quarter

- $95 annual fee

- 5x travel booked via Chase (2x all other travel)

- 3x dining, streaming services, & online grocery

- $50 annual hotel credit

- $550 annual fee

- 10x hotels & car rentals booked via Chase

- 5x flights booked via Chase

- 3x on all other travel and dining

- 10x Lyft (through March 2025)

- $300 annual travel credit

- Primary rental car insurance

- Priority Pass lounge and Priority Pass restaurant membership

- $5 monthly DoorDash credit

- $395 annual fee

- 10x miles on hotels and rental cars booked via Capital One

- 5x miles on flights booked via Capital One

- 2x miles on all other purchases

- $300 annual travel credit

- 10k bonus miles each anniversary

- Priority Pass lounge membership

- Primary rental car insurance

- Plaza Premium and Capital One Lounge access

- $95 annual fee

- 2x miles everywhere

- 5x miles on hotels and rental cars booked via Capital One

- $150 annual fee

- 3x on travel & transit

- 3x dining

- 1x points on other purchases

- $189 CLEAR annual credit

- $250 annual fee

- 3x points for flights booked with airlines via Amex

- 4x points at US Supermarkets

- 4x dining worldwide

- 1x points on everything else

- $10 monthly Uber or Uber Eats credit

- $695 annual fee

- 5x points for flights booked directly with airlines or via Amex

- 5x points for prepaid hotels booked via Amex

- $200 airline credit

- $200 hotel credit when booked via Amex FHR or Hotel Collection

- $20 monthly entertainment credit

- $15 monthly Uber or Uber Eats credit

- Priority Pass lounge membership

- Centurion Lounge access

- Hotel and car rental elite status

- $189 CLEAR credit

- Trip cancellation/delay insurance

Earning Travel Points & Miles: Shopping Portals & Points Stacking

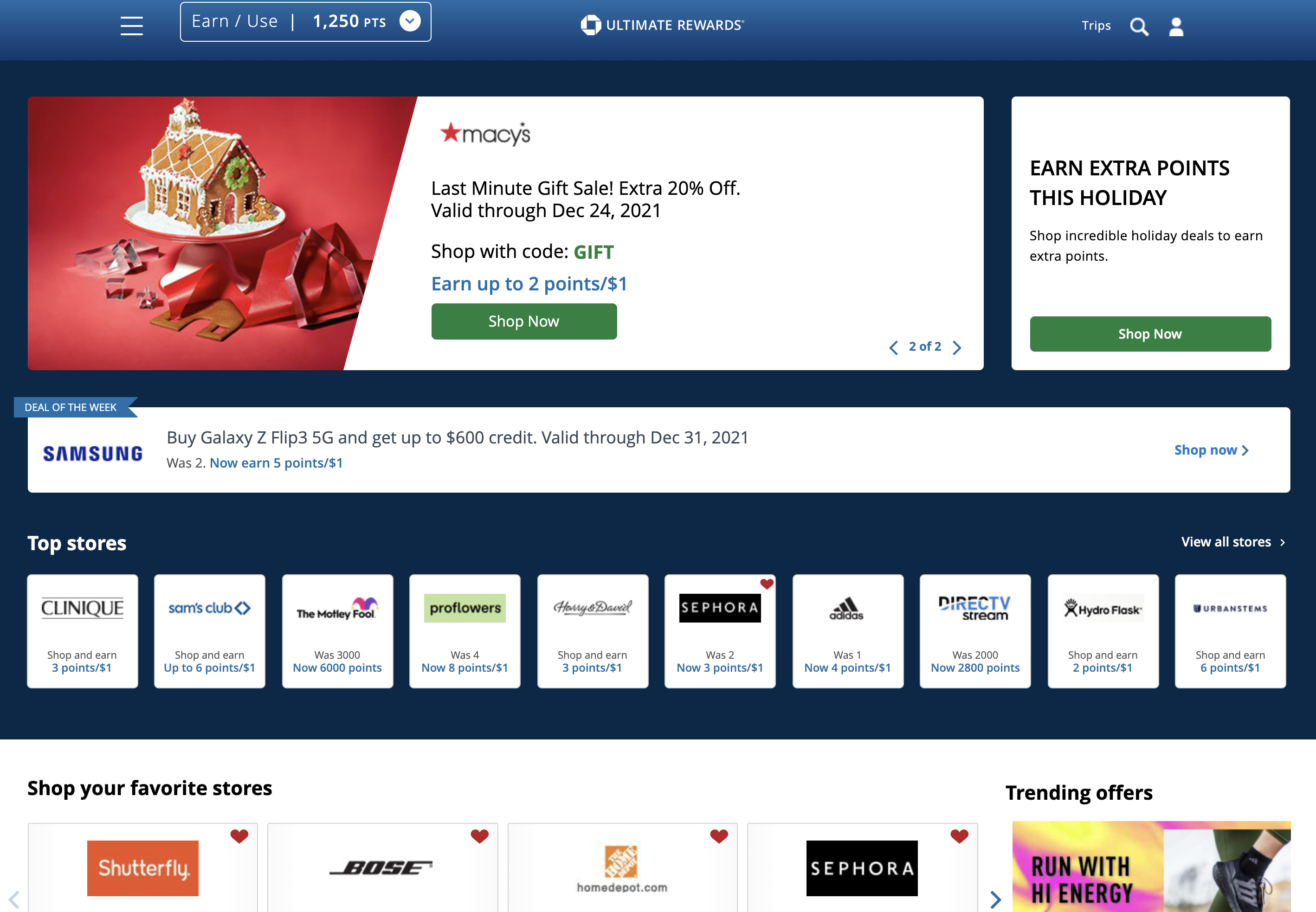

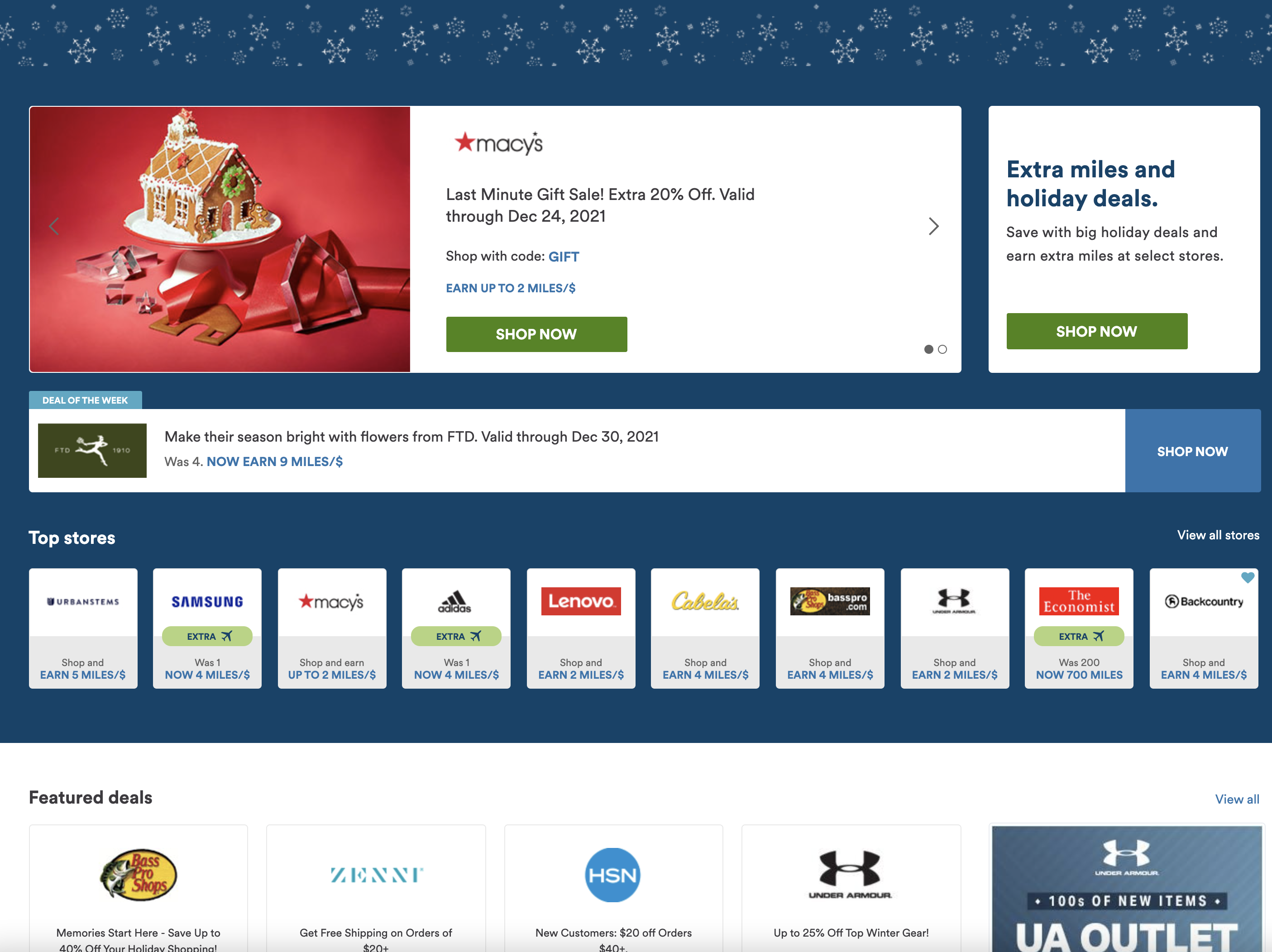

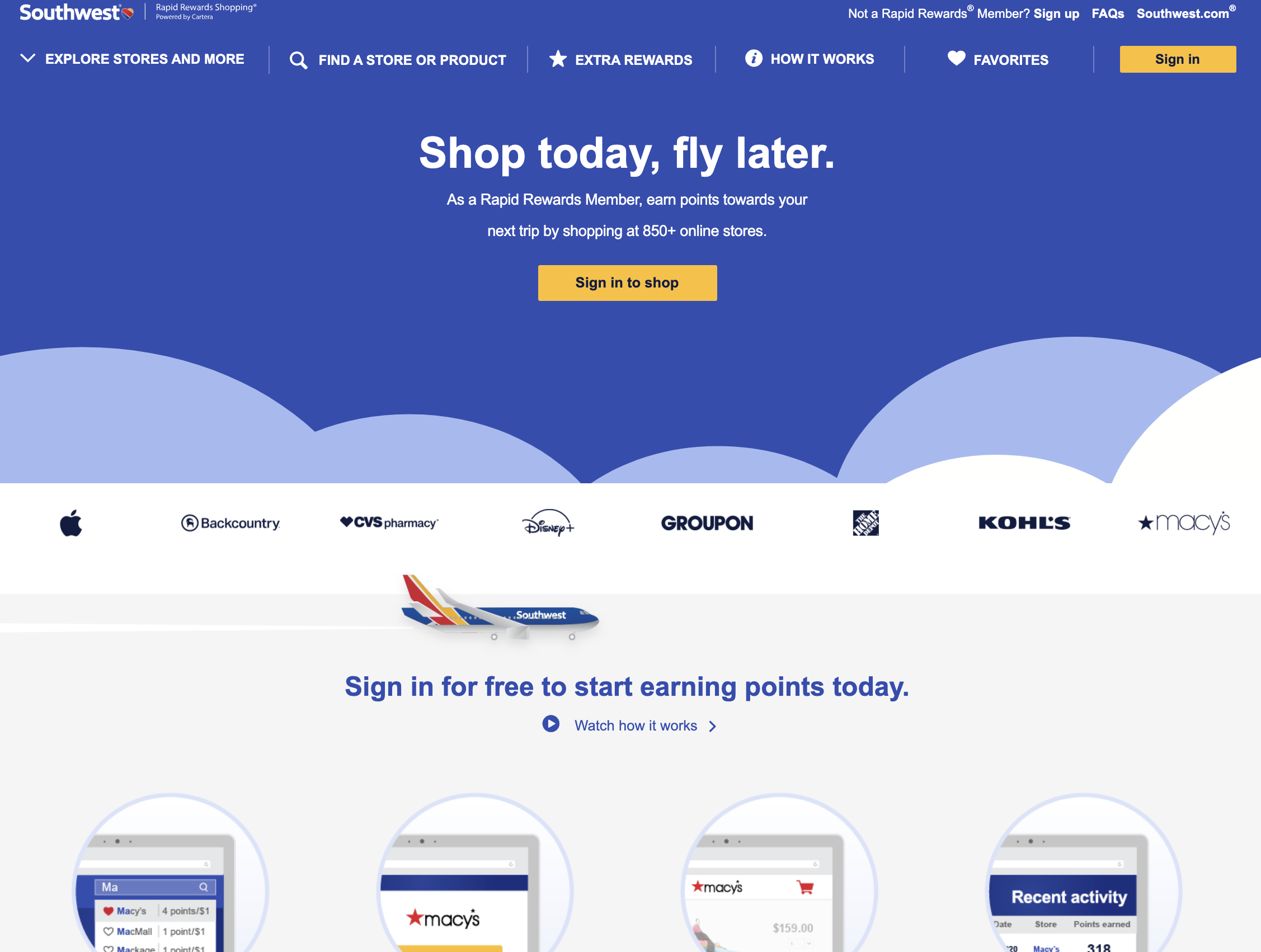

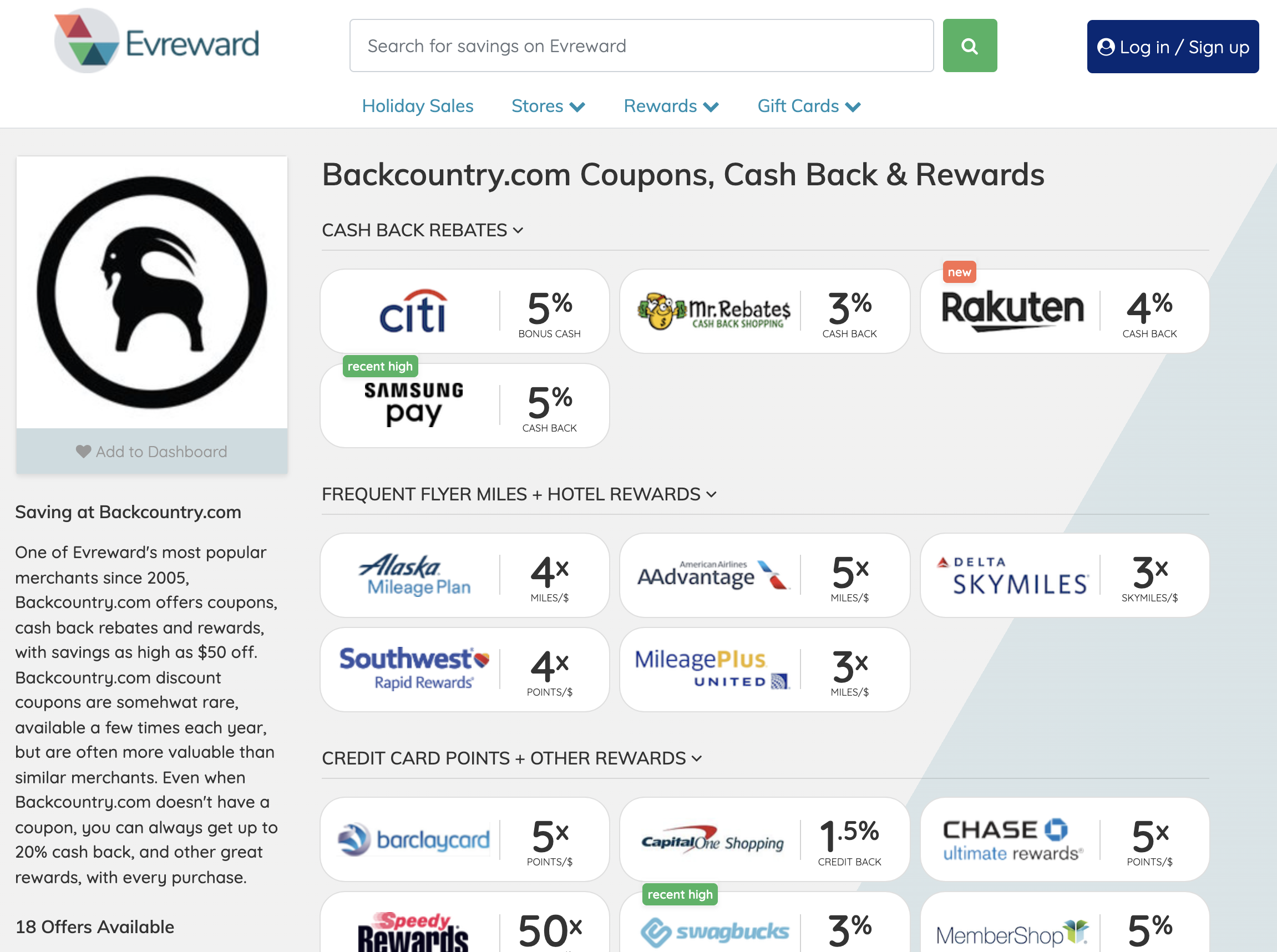

Online shopping portals are our one of new favorite discoveries within the past couple of years. The easiest way to explain a shopping portal is that it is a centralized website to shop at hundreds of online retailers where you can click through to the actual retailer/online merchants site to earn extra cash back, bonus miles, and points .

There are a variety of ways to earn extra points on things you already plan to purchase and you can often times earn 2 to 10 times extra bonus points to redeem for points and cash back.

For example, let’s say that I was looking to buy a new pairs of shoes. I would first start by figuring out which credit card would help me maximize on points from the purchase itself from that vendor. In most cases, we would select our Chase Freedom Unlimited which gives us a base of 1.5 times points on all purchases. Here is a scenario if we were to buy a pair of shoes that cost $95 from Zappos.com.

If you go directly to Zappos.com and buy the shoes, this is how many points you earn:

- $95 for shoes x 1.5 points earned per dollar on the Chase Freedom Unlimited = 142.50 points.

If you purchase the same shoes by first clicking through a link in a shopping portal like Chase’s Ultimate Rewards shopping portal that then directs you to Zappos.com:

- Chase’s shopping portal is offering 5 times points when you click through and shop from Chase’s portal that directs you to to Zappos.com. You can earn $95 for shoes x 5 times points from Chase’s shopping portal = 475 points

- You also earn $95 for shoes x 1.5 points per dollar for using the Chase Freedom Unlimited credit card = 142.50 points.

- Total points earned = 617.50 points

If you would have started directly on Zappos.com, you would’ve missed out on earning 475 extra miles. You are already buying the item, so why not earn the extra miles?

So how are shopping portals able to give extra points, miles, and/or cash back? Shopping portals make their money through advertising dollars as well as the online retailer gives a percentage of what you buy to the shopping portal that directed you.

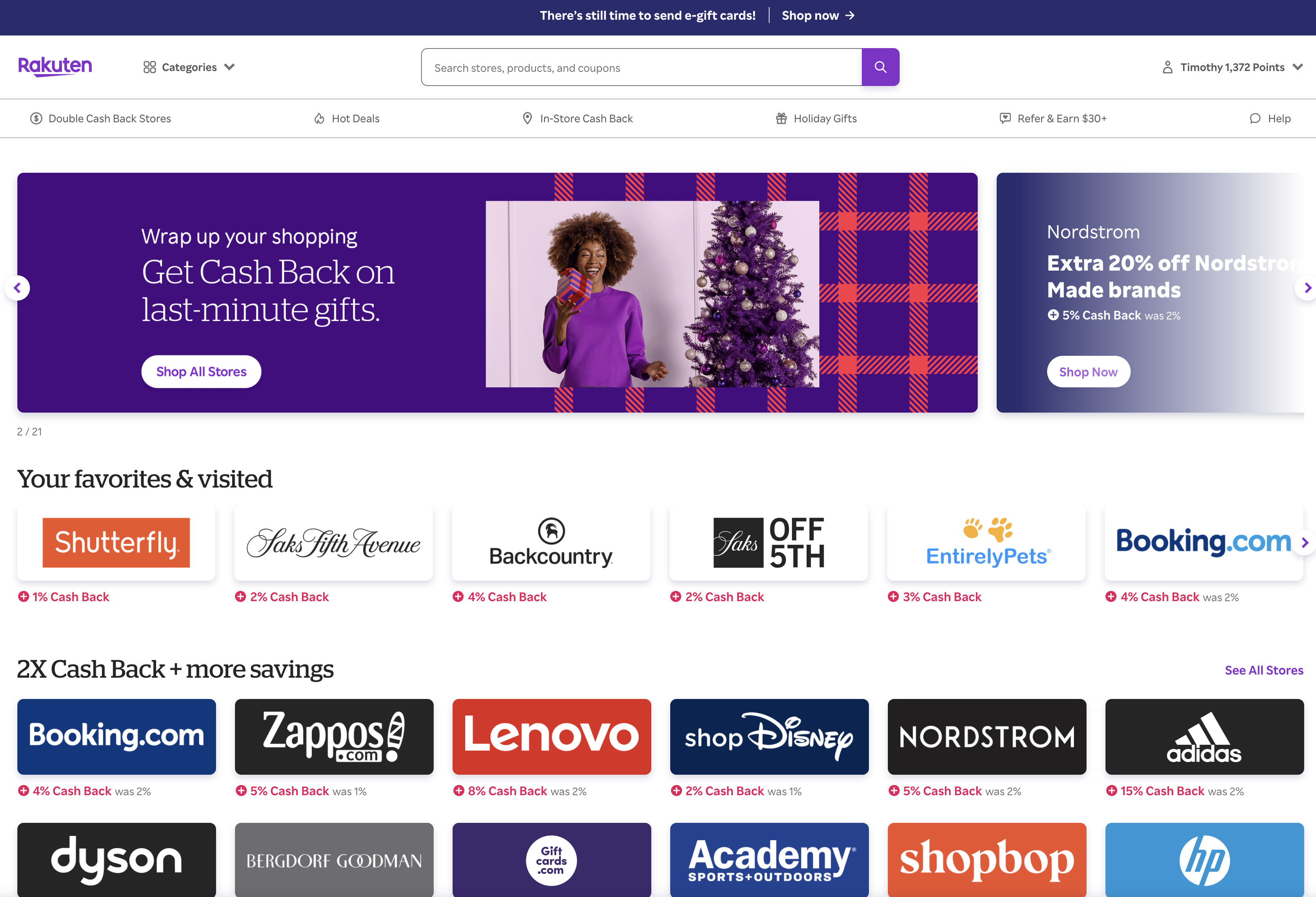

There are shopping portals through airlines, credit cards, and even independent ones like Rakuten.com that allow you to earn points that can also be linked to an American Express credit card where the points can be transferred into American Express Membership Rewards points or redeemed the points for cash back.

Also, we use websites like evreward.com and cashbackmonitor.com to quickly check all the shopping portals in one place and to see which shopping portal is currently offering the most points with a specific online retailer.

Often times your credit card will also have its own designated shopping portal or one time offer deals that you typically have to activate online (or in their mobile app) that will provide extra points earned directly on the app/online website you use to see you credit card transaction and balances.

If you want to take a deep dive into shopping portals, here is a super useful article from The Points Guy.

Pro-tip: On different shopping portals, you can favorite and set-up alerts for your go-to retailers that notify you when the points values increase.

Our Recommended Shopping Portals

Travel Budgeting and Planning Tips

We have always been pretty good about planning our travels out so we can get the best value for our dollars spent. Booking things ahead of time often times means money saved.

Below are five strategies that we have used over the years to spread out the cost of our trips, as well as budget for our trip before, during, and after our travels.

1. Booking our flights ahead of time: Not only do you get better flight times, minimal layovers, and seat options, but generally the cost in our experience has been lower. We book international flights at least 6 months out and sometimes up to 10 months in advance depending on location. For domestic flights, we often book 3 months out for the lowest rates. If you redeem airline miles around 3 months out from the trip, you can often find lower airline mile redemption options!

We love to use Google Flights to track flights and to search across multiple airlines. We turn on the “track flights” for specific dates we are exploring.

Pro Tip: Remember you can also choose to book your flights directly through the credit card travel portals to redeem your credit card points or pay your flight cost with a credit card that gives 3 to 5x points for travel when booked directly with the airline carrier. For example, when we book flights on Alaska, American Airlines, or Southwest, we often times use our American Express Platinum for the ticket purchases because we will earn 5 times points.

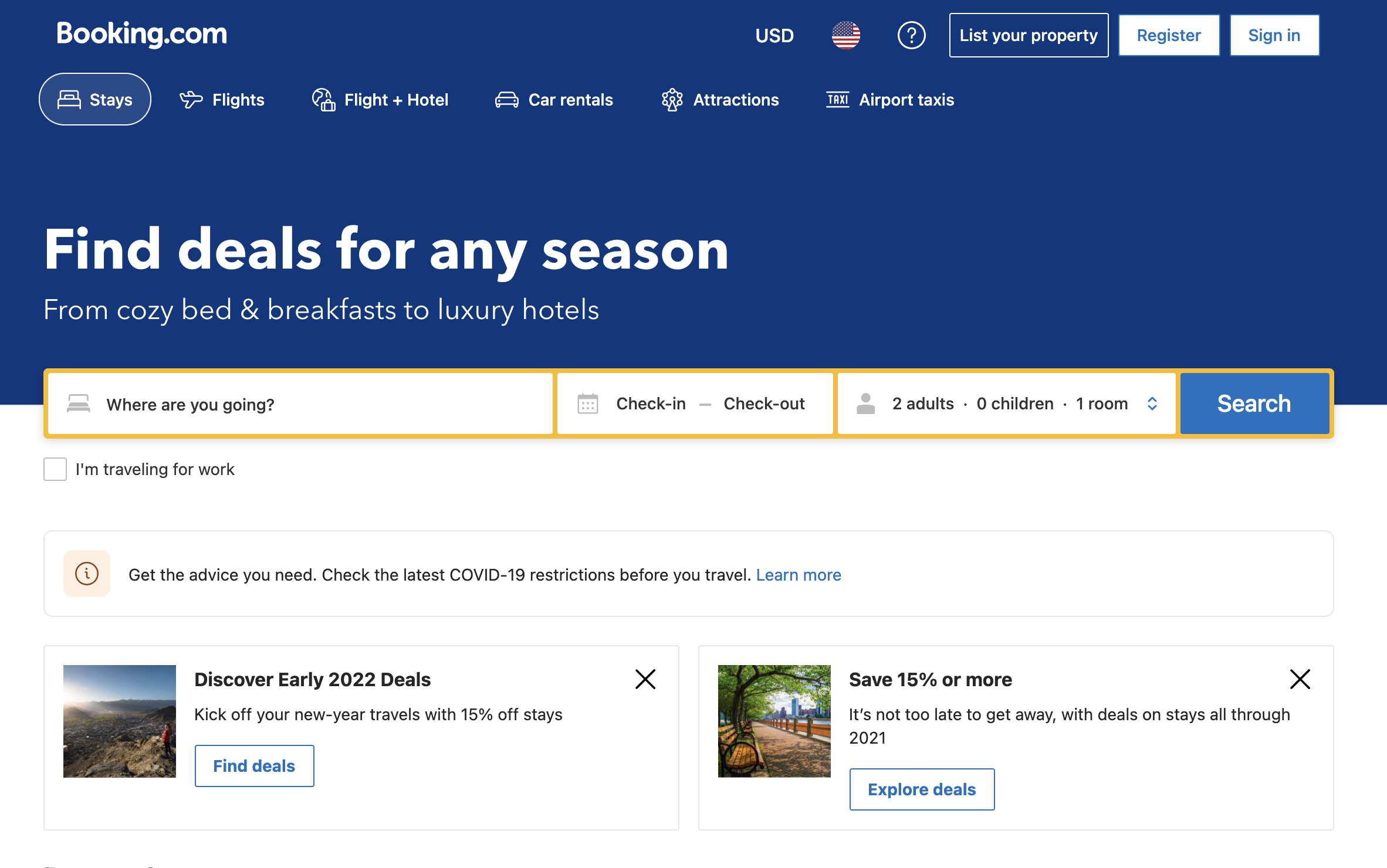

2. Booking accommodations with a pay later option: Right after we book our flights we start looking for places to stay. This is Helen’s favorite part! We like to spread out our payments after spending money on flights, so we use websites like Booking.com and only find rooms with “free cancellation” and “no prepayment needed.” With this, you can lock in your prices without paying anything up front and you can continue to search for better room rates.

We also love to stay in Airbnbs to experience the local neighborhoods and have access to a kitchen to cook meals. We spread out our travel costs by selecting the two payment option, and also try to find accommodations with flexible (1 day prior) or moderate (5 day) cancellation policies.

Another Pro Tip: Remember to use a shopping portal like Rakuten.com to get to the Booking.com website so you can maximize and earn extra points, and then use a travel credit card like the Chase Reserve for 3x times on travel, which includes when you book hotels.

3. Find accommodations with a kitchen and free breakfast: We love to hike and eat when we travel. We burn a lot of calories hiking 10 to 20 miles per day during our travels so that also means we load up on calories. Our favorite places to stay have been at bed and breakfasts or “pensions” in places like Europe where breakfasts are usually included or at a small cost with your stay. We often eat (overeat) a large breakfast and pack a few snacks from breakfast such as fruit and bread rolls with Nutella packets for our hikes so we don’t have to eat lunch.

We often budget no more than $100 per day for food for the two of us combined when we are traveling no matter which city we visit, expensive or not. We enjoy have a kitchen or at least a microwave or toaster with refrigerator so we can make easy meals. When we aren’t hiking and exploring cities, we eat out for lunch (because it is cheaper…and there are often times lunch specials) and we buy produce from the markets to cook for dinner.

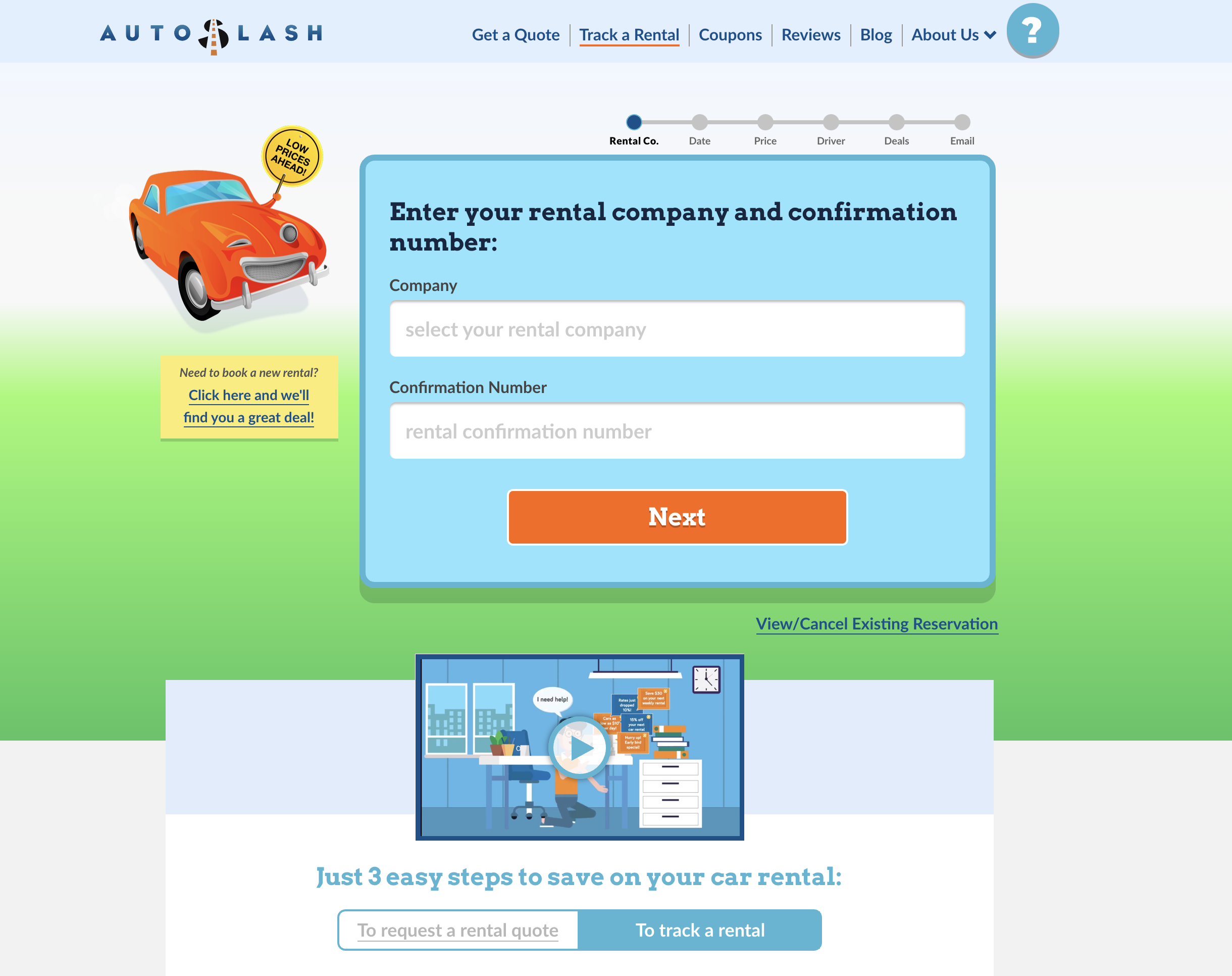

4. Rental cars pay later: Besides our accommodations, we like to also spread out the cost of our rental cars. We often use websites like Priceline.com or Costco Car rental because they have a pay-later option. The great things about both of those sites is that their cancellation policy is also free and usually you cancel for no fee. Just make sure you check the fine print on the cancellation policy. Just a couple of years ago, we discovered autoslash.com which can help you track your current car rental reservation and it will alert you if it finds a lower rental rate. We often cancel our reservations and rebook for the lower car rental rate.

5. Setting a daily budget when traveling – between entertainment, food, and public transportation: It can be hard to stick to a budget while traveling. It’s very hard for us and we often go over our daily budget. We usually set a $100 to $150 budget max per day (combined purchases each day) when we travel. This budget does not include our airfare, hotel, and car rental, since we have already either paid off or pre-budget for those items.

Luckily most of our hobbies like backpacking, hiking, and camping require minimal costs. We like to think that certain travel days we will spend under our budget and sometimes over, so it all evens out! When we are in the city, we love to check out free and low cost museums, farmers markets in the park, swim at the local lake (when allowed), and enjoy a nice local beer (or kombucha for Helen). Locals tend to hang out at breweries, so we can often feel out the local vibe by people watching.

6. Outlining your trip itinerary – And we don’t mean planning things to to the smallest detail to the hour, but having an idea of where you are staying, a few things you want to see, and places you want to eat at can be helpful.

We (Helen) likes to plan out her trip ahead of time, so using a simple google docs/sheets or marking them on Google maps to jot down destinations, hikes, researching food spots that may be within budget, as well as the cost of getting around. We often research 2 or 3 hikes per location and 2 to 3 restaurants and cafes through Google and Yelp to add into our planning list. Of course this is dependent on how long you are traveling for and how long you will be staying at each location.

Sometimes mountain towns can be very remote so we need to book bus and train tickets ahead of time. We have definitely pulled an Amazing Race style dash to catch our trains.

Check out this new app and start-up Helen found called Wanderlog that can help you can put together a plan and look up destinations and activities to build your itinerary and mark on a map, all in one place.

Our Top Travel Planning and Budgeting Resources

Top Travel Points and Miles Websites

The Points Guy

The Points Guy is our go-to website on strategies and tips to accumulate travel points and miles. We visit this website for travel updates, the latest trends in travel, and credit card reviews.

Frequent Miler

Frequent Miler is a blog on how to maximize points and miles and how to get the most value for your points.

One Mile at a Time

One Mile at a Time focuses on elite travel and provides information on breaking travel news, reviews, and strategies to earn and redeem miles.

10xTravel

10xTravel website has a goal to help you travel more and to spend less through content related to credit card rewards, personal finance, travel, and lifestyle.

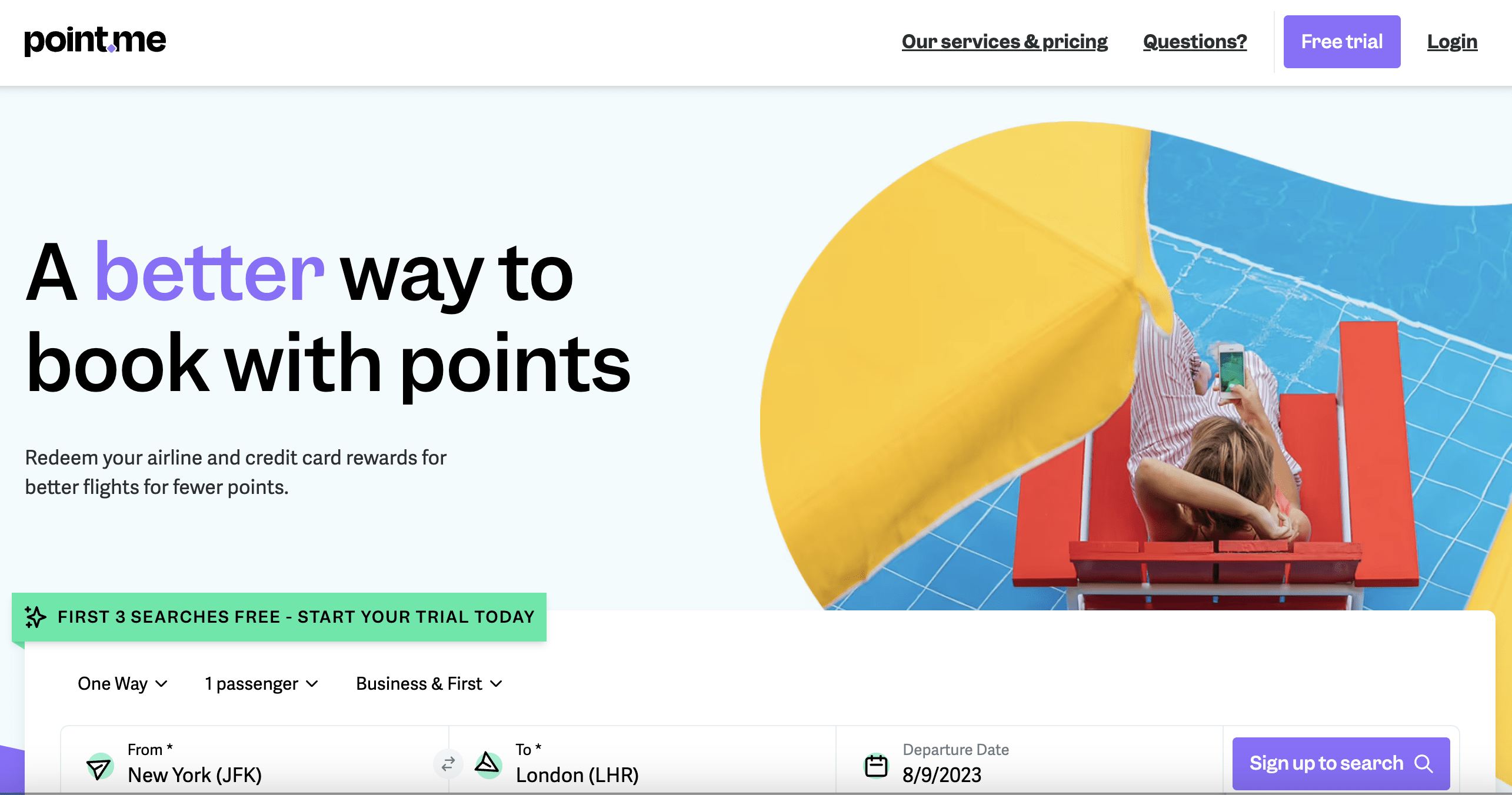

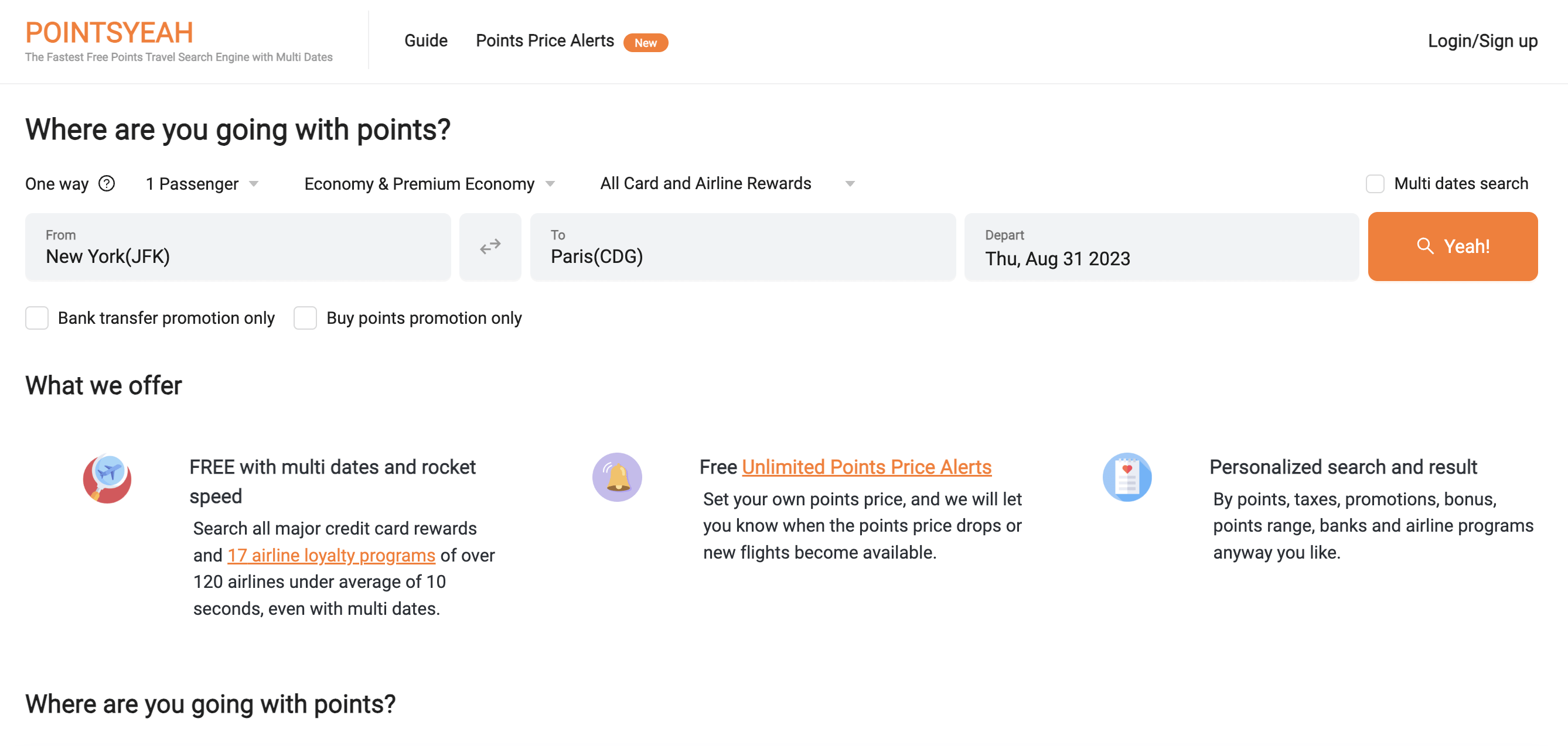

OUR FAVORITE AWARD FLIGHT SEARCH TOOLS

OUR FAVORITE AWARD FLIGHT ALERT NEWSLETTERS

OUR FAVORITE TRAVEL POINTS AND MILES PODCASTS

Our Travel Vlog

We’re Helen and Tim Travel! We have a goal to see the world one mountain at a time.

be prepared and adventure longer

Our Hiking Gear

retire early

FIRE MOVEMENT

check out our adventures

YouTube Channel